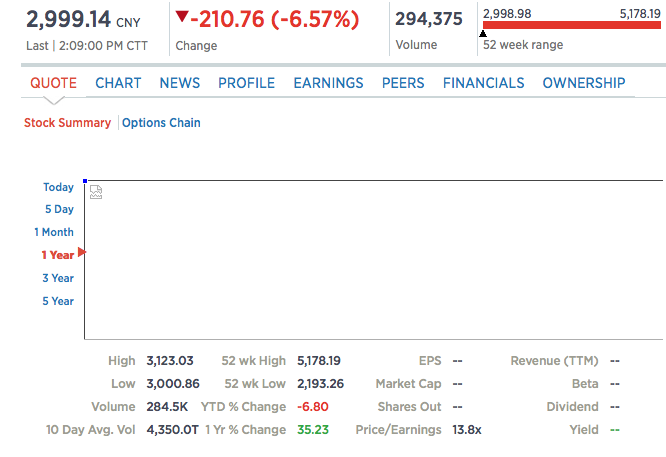

The Asian markets are again taking a beating, just prior to London opening. With the market turmoil continuing only time tells about what is to come in the future and that is why economists are warning to stock up on canned food. Video Here.

China takes another battering.

China’s Shanghai Composite index lurched lower in the final hour of trading to fall below the key 3,000 mark, hitting its lowest level since December 2014. Among China’s other indexes, the blue-chip CSI300 index and the smaller Shenzhen Composite sagged 6.7 and 7.1 percent, respectively.

[poll id=”3″]

In the previous session, the Shanghai bourse nosedived nearly 9 percent to chalk up its biggest one-day percentage loss since 2007, leading state media Xinhua News Agency to describe the tumultuous trading session as “Black Monday.” According to Reuters, the Shanghai bourse has given up all its gains for the year.

Analysts pinpointed Monday’s market slump at an erosion of faith and confidence among investors, particularly overseas traders.

“Chinese regulators have enormous resources and tools to normalize the market [but] investors are very disappointed with the policy responses from China thus far. There is a sense that the government responses have been unorthodox, ineffective and unhealthy for the long term functioning of the Chinese capital markets,” Bruno Del Ama, CEO of Global X Funds, told CNBC’s “The Rundown.”

According to IG’s market strategist Bernard Aw, there is no easy explanation for the meltdown in the mainland markets, which indicates that significant downside risks remain.

“Some blamed it on the yuan devaluation and the Chinese [factory activity] readings. Some said the broader conditions of slowing global growth, falling commodity prices and deflation risks dragged equities down. They could all be right,” Aw wrote in a note issued late Thursday. “But I feel that the lack of clarity on what was the trigger for the stock slump makes it difficult to get a sense of the market – this suggests that the selloff could still have some room to go.”

From a technical perspective, the Shanghai Composite is seeing a temporary support level at 2,800, according to independent technical analyst Daryl Guppy. However, in the long run, the bourse will trend nearer to the support level of 2,400.

![[VIDEO] Drag Queen Drag Shows Are Now Infesting Churches](https://christianjournal.net/wp-content/uploads/2019/11/Screenshot-2019-11-22-at-9.02.01-PM-218x150.png)

![[VIDEO] Drag Queen Drag Shows Are Now Infesting Churches](https://christianjournal.net/wp-content/uploads/2019/11/Screenshot-2019-11-22-at-9.02.01-PM-100x70.png)